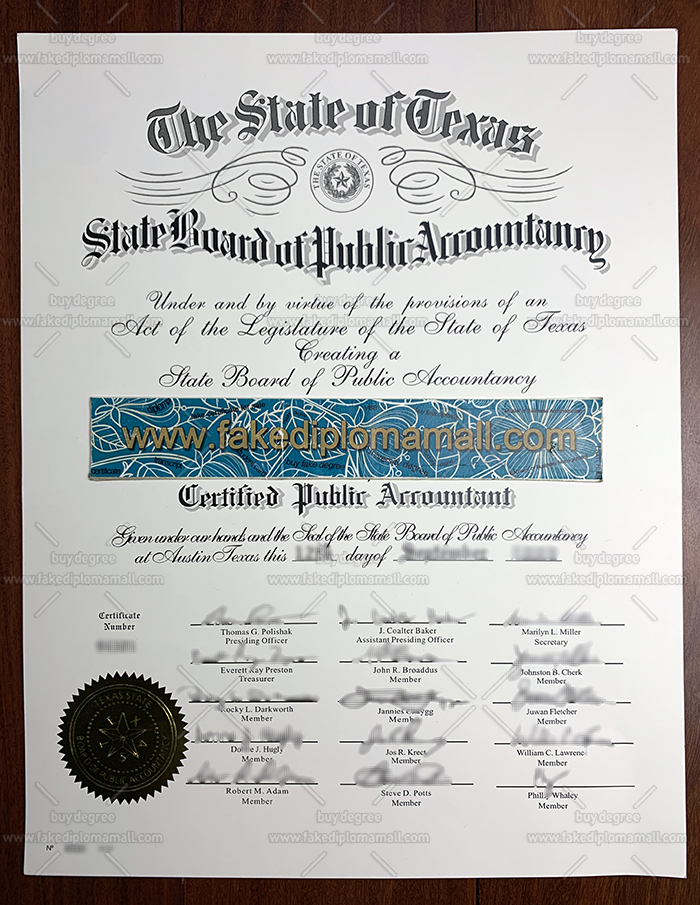

Where to Order a Fake Texas CPA Certificate?

Texas is also one of the most popular candidates for CPA exams in the United States. State of Texas CPA, Fake CPA Texas. To help you choose the test-taking state that suits you, the China Accounting Network School has specially compiled the AICPA exam requirements for Texas.

Driven by economic globalization, accounting standards of various countries are becoming more and more internationalized and unified, and US accounting standards have great influence in the process of updating international accounting standards. The US CPA qualification is widely recognized in 64 countries and regions including China. It is an authoritative international accountant qualification; it is a powerful individual with international accounting, financial, legal knowledge and skills. Proof; it is also the necessary knowledge preparation for business and business; it is also a powerful weapon to enhance professional functions and professional background. This qualification is an international authority, more representative of international accounting standards, and a symbol of the ability of practitioners.

The US CPA has just landed in China, and its development prospects in China are generally optimistic. In recent years, how can I apply for a Texas CPA certificate? Where to buy Texas CPA certificate? Buy fake Texas CPA certificate, how to get Texas CPA fake certificate, this demand has been particularly evident as more and more Chinese companies have gone public in the US capital market and more and more US companies have entered China. Data from the Chinese Institute of Certified Public Accountants show that they are eligible for USCPA status in China. The number of people is still very small. At present, there is a gap of about 250,000 talents who understand US accounting standards (US GAAP) and have US CPA qualifications. In the recruitment advertisements of the Big Four accounting firms and multinational corporations, almost all of their recruiting financial positions require candidates to hold US CPA qualifications. With the internationalization of accounting and the popularization of International Accounting Standards (IAS), both Chinese companies listed overseas and domestic well-known companies or accounting firms in Europe and the United States are more likely to recruit American CPAs. Applicants are engaged in financial management.

The 2012 AICP Candidate Data from NASBA provided detailed analysis of the test performance of 8,503 candidates from 101 countries. buy California fake CPA certificate, buy Illinois CPA certificate, buy Florida CPA certificate, As can be seen from the data, the number of Chinese candidates in 2012 reached 741, which is an increase of 195% compared with the number of exams in 2011. Compared with the number of exams three years ago, the number of exams increased by 394%, and the number of candidates ranked fourth in the world!

The data shows that the average pass rate of Chinese candidates is 43.1% (down from 49.3% in 2011), ranking fourth in overseas regions; the average score of Chinese candidates is 70.4, which is the highest in overseas regions.

What are the advantages of the US CPA?

Wide recognition: The United States is the world’s largest economy. Among the world’s top 500 companies, US companies account for nearly 40%, while US-owned companies are widely distributed throughout the world;

High gold content: The US capital market is one of the largest and most mature capital markets in the world, and the corresponding financial requirements are the highest. The GAAP guidelines have always led the development trend of international accounting. At the same time, the US accounting standards are very much in the process of updating the international accounting standards. Great impact.

Short test period: only 4, compared to Chinese CPA6+1 or ACCA’s 14 courses, the subject is less, the cycle is short, want to be Texas CPA member, how to become the Texas CPA member? how to pass the Texas CPA exam? and the test can be completed in about one year;

The exam format is more flexible: based on multiple-choice questions;

Flexible test method: You can make an appointment for the test according to the student’s own study situation. You can take the test for 8 months throughout the year;

The exam pays more attention to the ability of professional judgment than to test it;

At present, the domestic talent gap is large, the annual salary is high, the per capita annual salary is more than 400,000, and the career development space is large. It is the priority employment condition for the recruitment of financial managers and financial directors of foreign enterprises.